Tax Brackets 2025 For Married Filing Jointly. When deciding how to file your federal income tax return as a married couple, you have two filing status options: Tax brackets for married filing jointly in 2025.

In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700). Rate married filing jointly single individual head of household married filing separately;

Tax Filing 2025 Usa Latest News Update, Single filers and married couples filing jointly; 2025 federal income tax brackets and rates for single filers, married couples.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, To figure out your tax bracket, first look at the rates for the. Married filing jointly or married filing separately.

What Is My Tax Bracket 2025 Blue Chip Partners, You can figure out what tax bracket you’re in using the tables published by the irs (see tables above). 2025 federal income tax brackets and rates for single filers, married couples.

Irs Tax Brackets 2025 Married Filing Jointly Ambur Bettine, In 2025, the irs married filing jointly tax brackets are: Your bracket depends on your taxable income and filing status.

What are the Different IRS Tax Brackets? Check City, In 2025, married filing separately taxpayers get a standard deduction of $13,850. Based on your annual taxable income and filing status, your tax.

Anh Le's Tax Planning Guide 2025 Tax Planning Guide Brackets and Rates, You earn a capital gain when you sell an investment or an asset for a profit. Above $609,350 for single filers and above $731,200 for married couples filing jointly.

2025 Tax Brackets Married Filing Jointly Irs Printable Form, In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700). When deciding how to file your federal income tax return as a married couple, you have two filing status options:

2025 Tax Brackets Married Filing Jointly INVOMERT, Page last reviewed or updated: Married filing jointly or married filing separately.

IRS Tax Brackets AND Standard Deductions Increased for 2025, When deciding how to file your federal income tax return as a married couple, you have two filing status options: The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts.

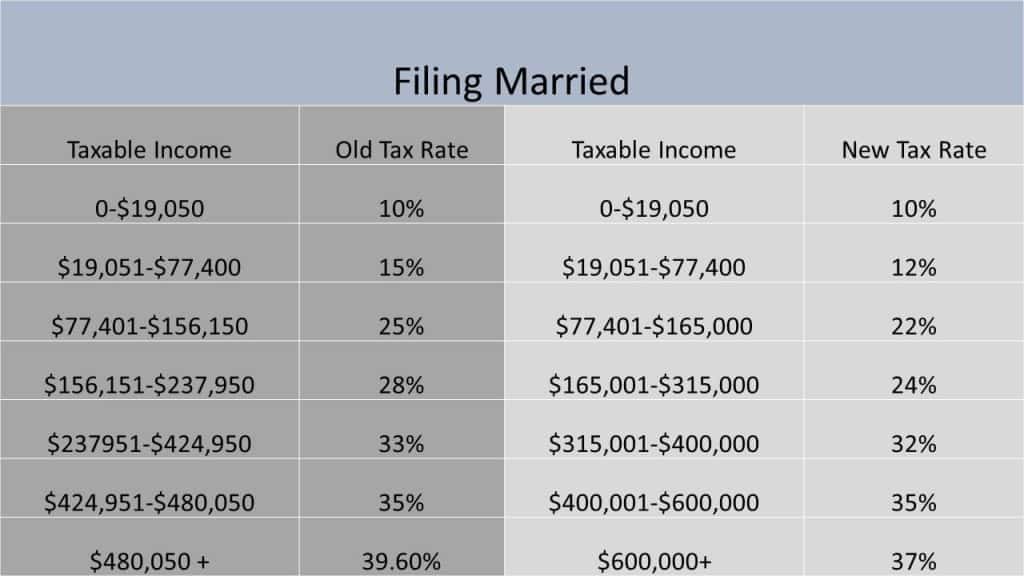

How does the tax bill affect me and my paycheck? The Physician, Tax brackets for married filing jointly in 2025. For the 2025 tax year, the standard deduction is $29,200 for married couples who file jointly and $14,600 for both single filers and married filers who file separately.

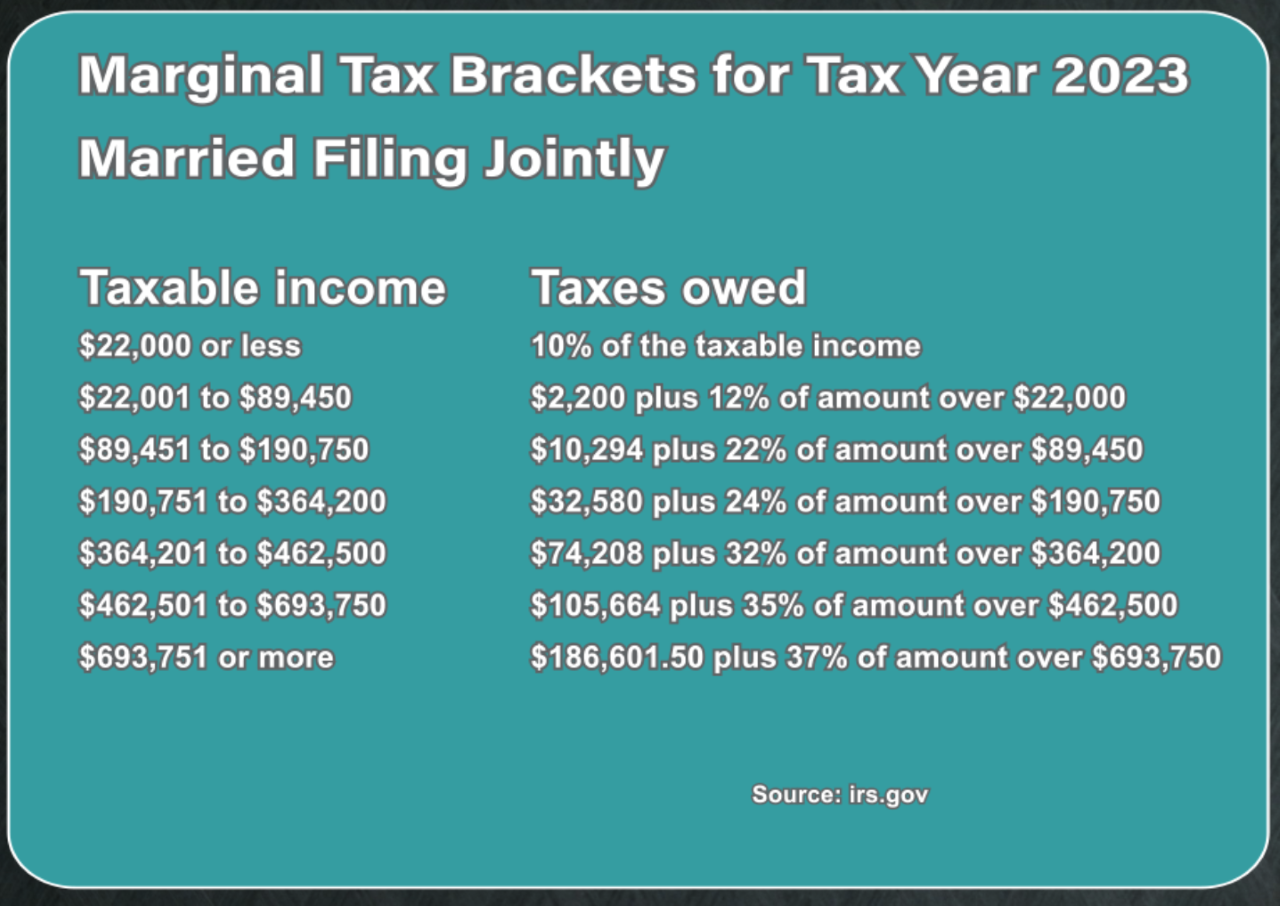

Tax brackets for married couples filing jointly —$23,200 or less in taxable income — 10% of taxable income —$23,200 but not over $94,300 — $2,320 plus 12% of.

The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts.