Texas State Taxes 2025. If you make $70,000 a year living in texas you will be taxed $7,660. March 27, 2025 — 01:41 pm edt.

Explore the latest 2025 state income tax rates and brackets. The texas state tax calculator (txs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

Texas Federal Tax Rate 2025 Lora Sigrid, 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes. See states with no income tax and compare income tax by state.

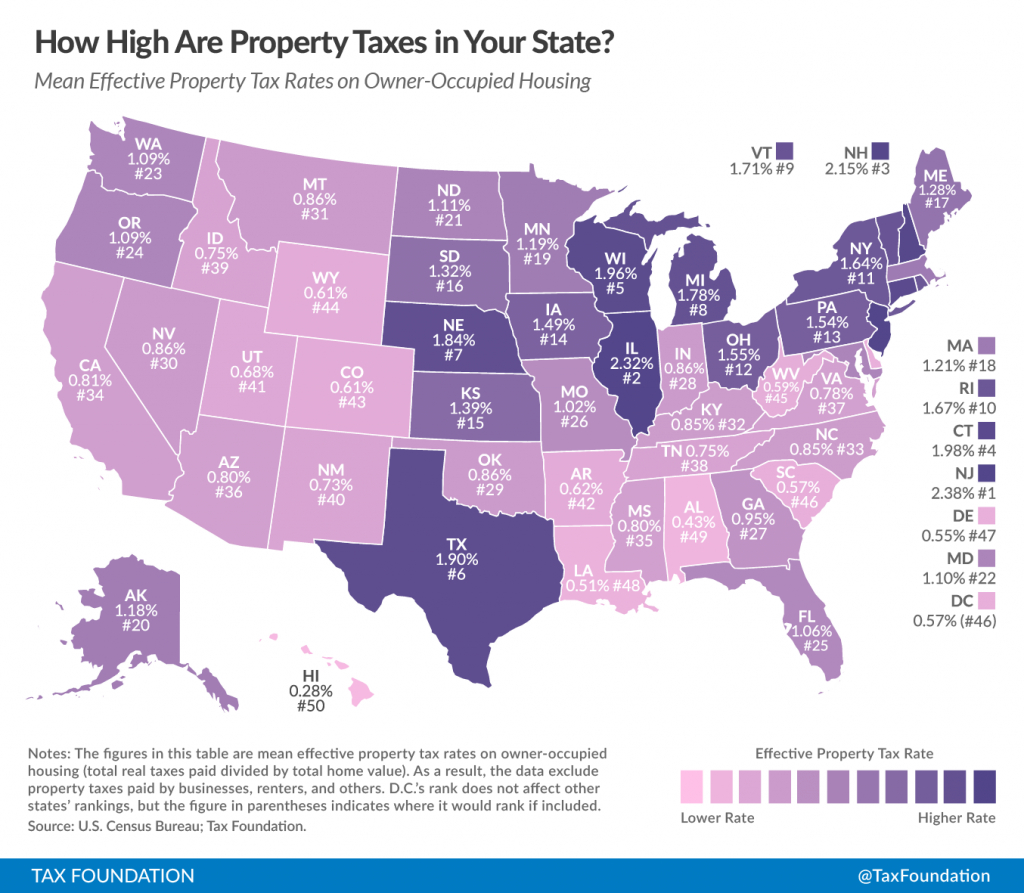

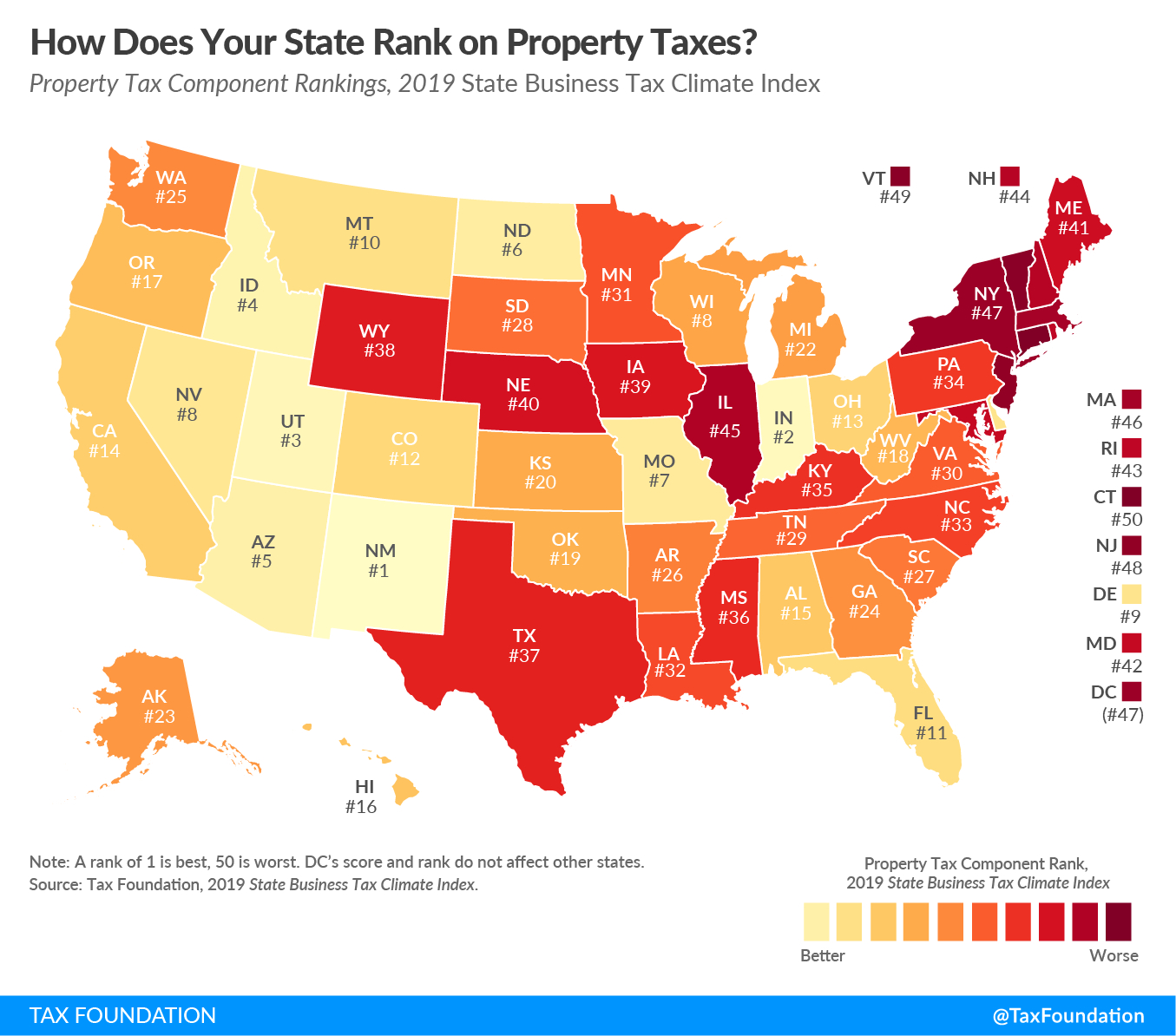

How High Are Property Taxes In Your State? Tax Foundation Texas, Here are the 2025 deadlines. The next powerball drawing is monday, april 1, at 10:59 p.m.

How High Are Property Taxes in Your State? American Property Owners, The texas state tax calculator (txs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. Daniel bunn, cecilia perez weigel.

US Property Tax Comparison By State Armstrong Economics, The next powerball drawing is monday, april 1, at 10:59 p.m. By now, you’ve probably memorized the fact that tax day.

Tax rates for the 2025 year of assessment Just One Lap, Your average tax rate is 10.94%. How is income taxed in texas?

The Kiplinger Tax Map Guide To State Taxes, State Sales Texas, The annual salary calculator is updated with the latest income tax rates in texas for 2025 and is a great calculator for working out your income tax and salary after tax based on a. 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Updated for 2025 tax year on apr 1, 2025. You must send payment for taxes in texas for the fiscal year 2025 by may 15, 2025.

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, State taxes on powerball wins. The annual salary calculator is updated with the latest income tax rates in texas for 2025 and is a great calculator for working out your income tax and salary after tax based on a.

Tax payment Which states have no tax Marca, Texas property taxes [go to different state] $2,275.00. But there are other taxes that texans have to pay, such as significant property and sales taxes.

Tax Rates By State R2Cents, Your average tax rate is 10.94%. The annual salary calculator is updated with the latest income tax rates in texas for 2025 and is a great calculator for working out your income tax and salary after tax based on a.